The most commonly held view is that these five countries would start this bank with the idea of rivaling and maybe even displacing the US dollar as the world's reserve currency. This "meme" is apparently incorrect. The "BRICS Bank" is really closer to a version of the 1944 Bretton Woods Agreement (when the World Bank (called at that time the "International Bank for Reconstruction and Development") and the International Monetary Fund (IMF) were founded). Keep in mind that in 1944, World War II was not even over when they made the Agreement. The World Bank and IMF both started operating in late 1945.

Important Disclosure! I would not have been able to write this article without the help of a few individuals, ESPECIALLY one who wishes to remain anonymous. To my knowledge, all of what I write is true, based on some help I received and my own research. I thank various correspondents who chipped in various observations as well to make this a better article.

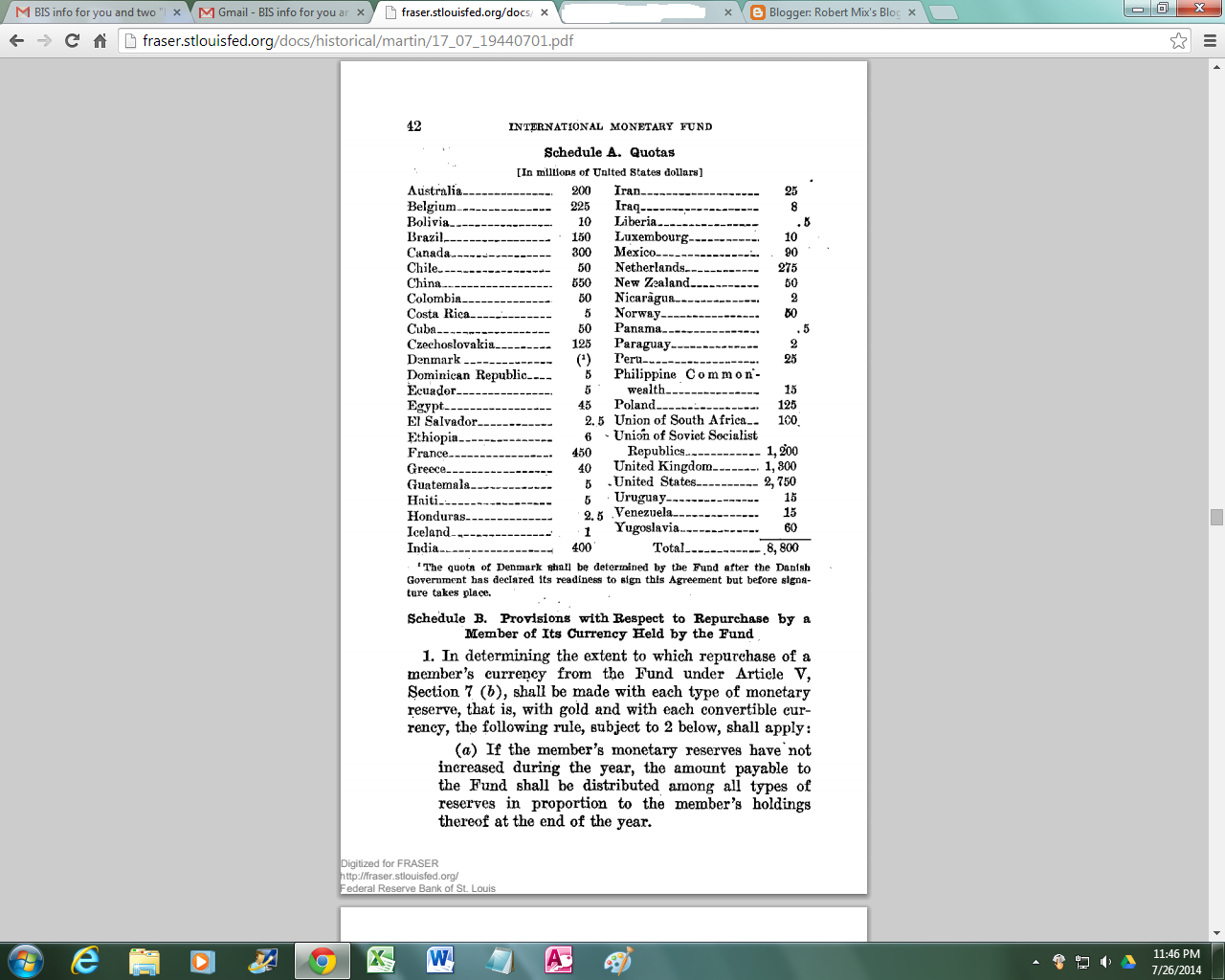

The Bretton Woods Agreement was agreed to by most of the large economies of the world at that time, not includng, of course, German, Italy and Japan (the Axis powers) who later DID join (both the World Bank and the IMF). China was an original member, Italy went on to join the World Bank and IMF in 1947, Germany and Japan joined both institutions in 1952. Sources:

http://www.worldbank.org/en/about/leadership/members

http://www.imf.org/external/np/sec/memdir/memdate.htm

There are a lot of parallels between Bretton Woods and the Fortaleza Agreements, some of which I will discuss, though not in a detailed way. All four of these Agreements are essentially complicated international treaties.

The "BRICS Bank" is actually to be two new institutions: The New Development Bank ("NDB") and the Contingent Reserve Arrangement ("CRA"). The NDB fairly well correlates with the World Bank, and the CRA roughly correlates with the IMF.

The NDB and World Bank mostly (will) focus(es) on infrastructure and similar lending to developing countries. The CRA and the IMF (will) focus(es) on lending like emergency funding (Greece) and funding to bridge over trade imbalances.

Here are the two relevant paragraphs from the "Fortaleza Declaration" (in blue, link here: http://brics6.itamaraty.gov.br/media2/press-releases/214-sixth-brics-summit-fortaleza-declaration), these show in general terms what the BRICS members have in mind re the NDB and the CRA:

12. The Bank shall have an initial authorized capital of US$ 100 billion. The initial subscribed capital shall be of US$ 50 billion, equally shared among founding members. The first chair of the Board of Governors shall be from Russia. The first chair of the Board of Directors shall be from Brazil. The first President of the Bank shall be from India. The headquarters of the Bank shall be located in Shanghai. The New Development Bank Africa Regional Center shall be established in South Africa concurrently with the headquarters. We direct our Finance Ministers to work out the modalities for its operationalization.

13. We are pleased to announce the signing of the Treaty for the establishment of the BRICS Contingent Reserve Arrangement (CRA) with an initial size of US$ 100 billion. This arrangement will have a positive precautionary effect, help countries forestall short-term liquidity pressures, promote further BRICS cooperation, strengthen the global financial safety net and complement existing international arrangements. We appreciate the work undertaken by our Finance Ministers and Central Bank Governors. The Agreement is a framework for the provision of liquidity through currency swaps in response to actual or potential short-term balance of payments pressures.

Text of the the two Agreements for the NDB and the CRA can be found here:

http://brics6.itamaraty.gov.br/media2/press-releases/219-agreement-on-the-new-development-bank-fortaleza-july-15

http://brics6.itamaraty.gov.br/media2/press-releases/220-treaty-for-the-establishment-of-a-brics-contingent-reserve-arrangement-fortaleza-july-15

These are long...

The official language is English, I saw nothing written about the Agreements being official in Mandarin, Russian or Portuguese (although, of course, official translations exist for the internal use of each country).

There is one big difference between the two sets of institutions, however. The World Bank and the IMF have 188 countries as members (almost all countries), while the NDB and CRA have but five.

***

First I wold like to examine a couple of main ideas of both the IMF and the CRA. One important issue is their participation, that is, how many countries are joining (there are five, although others may be admitted later on), and what their contributions are to be. The below (in blue) is straight out of the CRA Agreement:

Article 2 - Size and Individual Commitments

a. The initial total committed resources of the CRA shall be one hundred billion dollars of the United States of America (USD 100 billion), with individual commitments as follows:

i. China – USD 41 billion

ii. Brazil – USD 18 billion

iii. Russia – USD 18 billion

iv. India – USD 18 billion

v. South Africa – USD 5 billion

ii. Brazil – USD 18 billion

iii. Russia – USD 18 billion

iv. India – USD 18 billion

v. South Africa – USD 5 billion

http://fraser.stlouisfed.org/docs/historical/martin/17_07_19440701.pdf (page 52 of the pdf)

Not that it means much, but it may be worthwhile to note that in 1944 the US contribution was about 31% of total IMF contributions, in the CRA China is contributing 41%. In round numbers (and depending on whose figures you accept), China has as large an economy as all the rest of BRICS put together.

***

Another issue that is important to at least glance at is the role of gold in the four institutions. The IMF specifically mentions gold, and goes into some detail on gold's role in the IMF's planned operations. Here is a look at Article Four of the Bretton Woods IMF Agreement (recall that in 1944 that the US dollar was defined as 1/35th of an oz of gold):

Nowhere in the CRA is gold mentioned.

For that matter, gold is not mentioned in the NDB Agreement either.

Yet, I have read Jim Willie CB (rightly) discussing the importance of gold in the near future. In fact, he has written of "Gold Trade Notes" from time-to-time (in his free reports (he also writes much deeper reports that you can subscribe to), here is his website: goldenjackass.com). I was curious about the whole notion of Gold Trade Notes (apparently they would function as more-or-less replacements to the traditional Letters of Credit now heavily used in world trade), so I ran a Google search just tonight (early AM, 27 July). There are quite a few results, but every link I clicked referred back to Jim Willie, I saw NO independent articles discussing the Gold Trade Note that did not refer back to Dr. Willie. I of course concede that Dr. Willie's sources are much better than mine, there very well could be (likely ARE) private discussions between the BRICS members, especially among those hostile to the US dollar...

In some contrast to what Dr. Willie writes about China and Russia (the two core members of the "BRICS Bank" that are somewhat hostile to the USA), I have read elsewhere that China likely values its trade with the USA more so than their trade with Russia... While no doubt that China is seeking much greater long-term influence in the world's financial system, it does not appear that China would like to pay a price of bad trade relations with the USA or even Europe (Europe is now China's largest trading partner).

***

Another issue of likely major relevance is the possibility of conflicting goals among the members. While there is always some amount of disagreement among members of the World Bank and the IMF, the institutions seem to work pretty smoothly in accord with their missions. They have professionals working for them, who are relatively non-political and often are very talented economists (etc.). My wife worked for the IMF for some three years, and found the level of professionalism to be pretty high, and the level of (national-level) politics to be pretty low. (Yes, they DID have very nice Christmas parties, I had the fortune of being invited twice!)

I have reason to doubt that the NDB and the IMF will likely operate at a high level of professionalism and international politics taking a back seat. Please recall that the NDB and the CRA exist now because the BRICS members are not satisfied with the current structures of the World Bank and the IMF. These countries do have a case (that they are somewhat marginalized, emphasis somewhat).

It is my opinion that the "BRICS Bank" has been born out of frustration and resentment of the more developed world and the way the industrialized countries instruct the borrowers in what they are allowed to do and what not to do.

Also, note that the original term (acronym) for BRIC's (South Africa was recently added to have an African member) was a marketing slogan created by a Goldman Sachs analyst (Jim O'Neill). Other than resentment of the USA, Europe and Japan, there is relatively little that unites the current five members of the BRICS other than that they are "surplus countries" (exporting more than they import, and so are owners of a lot of US dollars). That the five BRICS have joined together must make Goldman Sachs crack a smile...

***

The NDB and the CRA do share many attributes of the World Bank and the IMF. Funding and voting share are fairly strongly correlated in the NDB and CRA (as with the other two).

The texts of both the NDB and the CRA seem to rule out highly concessionary ("easy") terms, and do appear to impose strict terms and repayment policies. Lending standards (at least what are int he Agreements) are rather strict. This appears to be prudent, but if the terms are not much easier, then why would poorer countries go there? Perhaps the terms are easier if the borrowers agree to buy products "Made in China"...

(Maybe I am missing something)

***

The World Bank and the IMF have come under much criticism, from both those interested in more open markets as well as those who want more "justice". One of the main sources of frustration among the poorer members of the World Bank, for example, is the voting power (number of shares) of each member. The voting power is roughly correlated with how much money each member has chipped in, less money contributed, the less influence a member will have... Also, funding to poverty-stricken (or countries in a temporary bind) is subject to oversight by the wealthy countries having the great majority of shares.

On the other hand, much lending over the years has resulted in money being lost to corruption and cronyism as well as projects of dubious value (dams).

There have been numerous reforms that have been passed and are still being examined by the World Bank and the IMF. As an example, much World Bank lending is now directed towards "sustainable development" and towards lowering carbon emissions...

Many of these reforms are already in the Agreements of the NDB and the CRA.

***

The prospects for the NDB and the CRA are uncertain, IMO. There are numerous examples of other international development "banks" that have not gained traction (eg, the Chiang Mai Initiative (early 2000s, in reaction to perceived inaction in resulting from the Asian Financial Crisis, and the BancoSur (2009) whose foundation was sparked by Hugo Chavez...). What?! You have not heard of those two international "banks", the Chiang Mai Initiative and the BancoSur? They failed... The BancoSur failed due to "internal contradictions", whoops, sorry Hugo Chavez...

The five BRICS members have relatively little in common other than they do not like the USA and Europe telling them what to do. To me, the NDB and the CRA almost seem like political documents, despite their similar appearances to the World Bank and the IMF.

They have internal rivalries that are papered over (India and China have not straightened out their borders (although progress maybe has been made), China vs. Russia in the longer term have rivalry issues over Asia and resources, Brazil has stronger trade ties to the USA than to China). Recall that China's economy dominates all of the others, that gives China a much greater influence over the NDB and the CRA than even the USA has over the World Bank and the IMF...

We will have to just wait and see. The US dollar is not dead yet. Each of the BRICS has substantial internal problems ("internal contradictions" for those of you schooled in Marxism) not often recognized by many observers. There are contradictions between the members, although the anti-Western ideas shared among them may for now eclipse any such rivalries.

Here are two other insightful articles written recently on the "BRICS Bank":

http://www.washingtonpost.com/blogs/monkey-cage/wp/2014/07/17/what-the-new-bank-of-brics-is-all-about/ (an excellent overview, albeit from the MainStream Media)

http://thedailybell.com/news-analysis/35498/The-Manipulated-Dialectical-Destiny-of-the-BRICS/ (a skeptical article from The Daily Bell, a libertarian internet newsletter)

We will just have to wait and see. A snippet from The Washington Post article may sum the "BRICS Bank" initiative up quite succintly:

Presumably a BRICS bank and reserve fund will need to ensure a high-quality loan portfolio that maximizes developmental impact, but keeps defaults to a minimum (for expanding the scale of lending operations, it would also be important to make profits on its loans). And so the problem of surveillance will have to be tackled. Unfortunately, the track record of regional initiatives on surveillance does not bode well.