Because of the agony this disease produces, among the five million sufferers and their families here in America, the pharma companies have obviously been looking into finding a cure or a way to stop the disease from advancing. Any significant advance in treating Alzheimer's would be a huge boon to our economy, and relieve huge burdens upon families of Alzheimer's victims.

The disease is not well understood by scientists, so the two new drugs being investigated may very well yield no important advances. The two drugs now in Clinical Trial Phase III (the step before FDA-approved clinical trials, so at an advanced stage of testing are Bapineuzumab made by Pfizer (PFE) / J & J (JNJ) / Elan (ELN) and Solanezumab made by E. I. Lilly (LLY). There are some other drugs that are in earlier stages, but these two are the furthest along. Despite both drugs ending in "-zumab" and both with the intent of clearing the brain of a plaque (but that plaque still has not been proven to shown to cause Alzheimer's), they work differently.

Alas, outside analysts put the odds of success for EITHER drug at 50% or less. There is still a LONG way to go before Alzheimer's is conquered...

***

Alan Abelson suggest that you "Curb Your Enthusiasm" in his latest piece. He starts off by picking on France again (it seems that a "Miss" no longer has to be addressed as "Mademoiselle", she can be a "Madame" now). Leave it to a coalition of President Sarkozy and Les Chiennes de Garde (The Female Guard Dogs -- yow!!!) now have made it possible for an unmarried lady to NOT have to disclose that fact... He then glides into the perilous state of the superstate of Europe and how the PIIGS are pulling Europe into recession, led by Greece (who else?) scheduled for a nasty -4.3%economic decline this year. Europe also faces having to roll over more than 2 trillion euros of debt this year, approximately $1 trillion more than we do...

Abelson then goes on to take another look at the fairly positive statistics that have come out of late, especially noting David Rosenberg claims that the January happy number housing report was really high because of the mild winter. Abelson then goes on to note some BAD things (Europe going into recession, again) and high oil prices ($4.159 / gallon for premium gasoline at the two nearest gas stations).

***

A nice little cartoon with a sign in front of a little B & B: Louisa's Bed and Fiber Breakfast Inn is on Page 10 of my edition. It brought a smile, OK?!

***

"He Said:"

He should just write a check and shut up... If he wants to give the government more money, he's got the ability to write a check -- go ahead."

-- New Jersey Governor Chris Christie

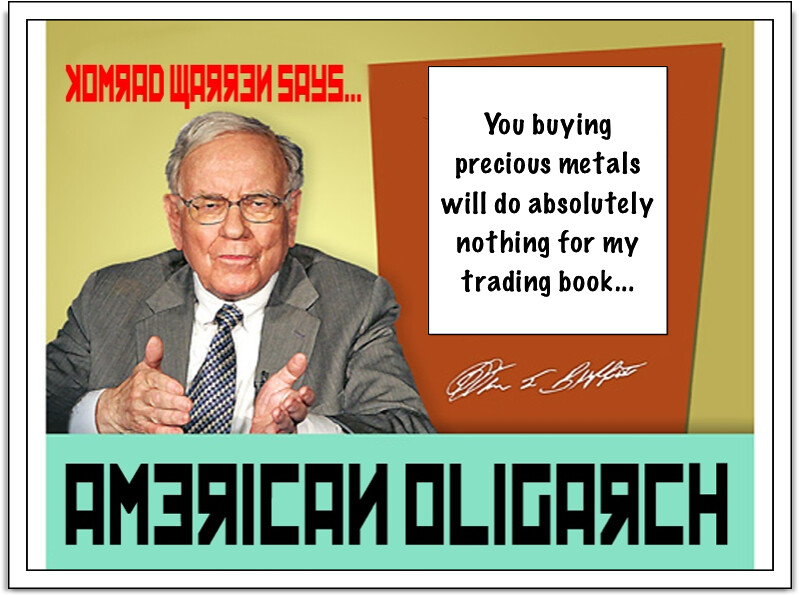

Yeah, Warren! STFU and write the damn check! Check out Zero Hedge's Master PhotoShopper WilliamBanzai7's take on the American Oligarch (along with The Limerick King's latest -- these guys have had a couple of nice join ventures over there):

Warren is talking his book

A guy who sure knows how to cook

A thousand lies told

About owning gold

Another American crook!

A guy who sure knows how to cook

A thousand lies told

About owning gold

Another American crook!

The Limerick King

On the same page are comments about a new book on etiquette in our new era: Would It Kill You to Stop Doing That?, by humorist Henry Alford. Yes, he did consult with "Miss Manners."

***

Beverly Goodman ("Fund of Information") writes of the rather surprising SEC interest in high frequency trading ("HFT"), often blamed (still not proven though) for the "Flash Crash" on May 6, 2010 (you may recall that day, the stockmarket dropped 9% in minutes. It seems that internet porn surfers have finally (yes finally!) are finally taking a good hard look. But, any ideas at this point are vague. And the notion that HFT is bad is still unproven (however if there is SO MUCH HFT going on, SOMEBODY must be making a lot of money). Perhaps it helps to remind you that 70% of all trading on the stock exchanges are HFT: robot vs. robot.

***

Mark Veverka ("Plugged In") notes that Microsoft will roll out their new Windows Version 8 at the Mobile World Congress (cell phones and similar). They will be using other chips than Intel's and AMD's for handsets and tablet computers...

***

Leslie P. Norton interviews the very interesting and informed Jeremy Grantham. Grantham is gloomy abhout the next seven years! He sees sub -normal growth because so much is over-priced now. The interview alone is almost worth the $5.00... Here's about all that he likes:

"I'm very partial to land. It's the key to building up long-term wealth... I like stuff in the ground -- metals, hydrocarbons, oil, even natural gas."

Much of that I agree with. But, land is immobile and can be taxed. Bad government could seize resources, even underground ones...

(Grantham agrees with my friend Eduardo P. here in the town where I live, he says his family never sells any land or property...)

***

Jim McTague ("D. C. Current") writes that internet poker is not likely to become legal anytime soon. Which may be just as well.

Recently I was in a casino after eating a birthday dinner (mmm, steak, wine, Caesar Salad). I lost five bucks to a computer blackjack machine while waiting on a drink. And my own Mom told me to go gamble a little! See what happens taking your Mom's advice sometimes?

***

Once again "CEO Focus" (by Lawrence Strauss) turned out to be very interesting. Strauss interviewed relatively new CEO of Southwest Airlines Gary Kelly, who took over 8 years ago from famed Herb Kelleher. It seems that Kelly has kept Southwest profitable even through all of the financial turbulence of the past few years while keeping to their successful model of using just Boeing 737 jets and their "point-to-point" flying model all the while keeping their employees happy and jokey to their fliers.

Our daughter tries VERY HARD to ONLY fly Southwest...

***

Gene Epstein, for the first time I have EVER seen in Barron's asks the biggest question of them all (well one of the biggest): "Is the Fed a Failure?"

WOW, that's really something. "Economic Beat" economist Gene Epstein considers George Selgin's work (U. of Georgia) and wonders:

"It will provoke us all to ask the heretical question: Should the Fed's 100th birthday be its last?"

This is the best piece I have read by Epstein. Keep questioning, brother!

***

Editor Thomas Donlan makes a really good case that Obama's latest tax machinations (lower corporate tax rate, but raising tax rates in other places) is completely misguided. I completely agree. If Obama wants corporations to invest here int he USA and create jobs, here are his five sensible suggestions:

1) Eliminate the corporate income tax altogether, it is a myth that WE do not pay it...

2) That would make our taxation more transparent to us taxpayers, clearly a good thing

3) Cripple the ability of politicians to steer capital to their favored business chums

4) Force half a million accountants and lawyers to find added-value work...

5) Eliminating tax-driven preference for debt financing

Here's a great quote by Donlan:

"Now the president is running as a corporate-tax reformer. He sends out his financial twerp Tim Geithner to denounce the distortion of the allocation of capital."

Priceless, Mr. Donlan, H/T to you sir.

***

In the Market Week section on Page 4 a company called Darling International (DAR) is discussed. These guys take rendering plant waste from slaughterhouses as well as cooking oil and baking waste and turn them into more usable products. What drew my interest is their new joint venture with Valero Energy (VLO) to refine 9300 barrels of diesel fuel per day...

***

Marshall Eckblad writes at "Commodities Corner" that lumber may be on the comeback trail! Economic stats are up, and maybe housing is moving off its bottom.

Well, maybe so, but I'll stick with gold.

***

Not much in the Classifieds this week. An Oklahoma oil well(s) producing 2000 barrels per day. Some wind turbine patents are up for sale as well.

***

I end with my usual money reporting. Clearly the Federal Reserve is fighting as hard as possible to delay holding a Total of over $3 trillion on its balance sheet. Total was down a miniscule $663 million (confirm that: million). Current total: $2,977,971 million (or $2.977 trillion). It will not be long until the Banksters have to fess-up and show us the lousy money they hold, all $3 trillion +++.

M1 and M2 virtually unchanged.

Currency in circulation up up over $7 billion (some 0.7% in a week)

Monetary Base up 1.8%

And, drum roll please, The Mighty Peruvian Sol is up again vs. the US$! Up a small 0.2%, but a win is a win!

Verdict: Yes, buy this issue if you liked anything discussed above.

Here's how to cut your electric bill up to 75%:

ReplyDeleteWant to know how to easily produce all of the green energy you could ever want right at home?

And you’ll be able to make your home completely immune from power failures, blackouts, and energy grid failures…

so even if everyone else in your area (or even the whole country) loses power, you won’t.

VISIT THIS SITE: DIY HOME ENERGY