The Cover Story ("Falling Star") in the weekend's edition of Barron's is about the case for a hard landing in China. China has become such a large part of the world's economy that it deserves a serious look at the possibility that China has a hard landing. THIS STORY is the single best overview of the dangers facing the Chinese economy that I have read, where so many topics are nicely tied together. I am going to comment at length on this article because I think it is important.

Author Jonathan R. Laing brings an impressive array of China experts who think that things do not look good:

-- Jim Chanos, famous China bear (at least recently). Chanos has been a short seller of certain Chinese stocks (banks and real estate developers) as well as miners like Rio Tinto (ticker: RIO) and Brazil's Vale (VALE). Laing: "...Chanos contends that China is headed for a hard landing of epic proportions because of its shaky financial system and an imminent collapse in its property market..."

Chanos himself told Barron's: "I'm being conservative when I say that the coming bust in China's real estate marketwill be a thousand times that of Dubai."

-- Edward Chancellor (global strategist at Boston-based GMO) says that China has all the earmarks of a classic mania that will end badly. Chancellor then goes on to say that he sees over-investment in fixed assets with inadequate returns. A toxic combination!

[Ed. note: more will be said about inadequate returns on invested money, which means capital destruction]

-- William Overholt (with a long career involving Asia), has been to date a China bull now believes that the state-owned enterprises (SOEs) is stifling the growth of leaner and more efficient companies. The SOEs have champions among the Chinese ruling party clique. The clique has great power and wealth -- a kleptocracy skimming off much of the prodigious amounts of money... (I used his words, but in a different order.) This favoritism will probably lead to a long-term stagnation like we have seen in Japan for over 20 years. But, Japan was rich when it hit stagnation, China is not...

-- Laing even brings in Paul Krugman, who who wrote in 1994 "The Myth of Asia's Miracle". Krugman writes that China just threw in large amounts of "economic inputs" (labor and, yes, capital) to get their growth up (like the USSR in the 1950s and Japan in the 1960s), but that state directed economies will run into diminishing returns on brute force economic methods like that.

Laing then goes on to write that Chinese consumption is actually FALLING (vs. government investment) and shows us this with a graph. His other graph shows the record level of new residential real estate as a % of GDP at a record high.

The SOEs also make bad use of their resources are very inefficient vs. their private enterprises, even with special tax breaks and low costs of energy and water provided by their .gov...

Infrastructure is the other big idea Laing explores. GMO's Chancellor talks of highway systems sparse traffic, local airports running at half-capacity and the technically marvelous rail system that cannot charge enough to pay for itself... Laing provided three pictures in his article:

-- A street shot in Kangbashi, China (a city built for a million people but inhabited just a few thousand) in which there are just TWO on the eight lane road between the (empty) apartment buildings.

-- A high-speed train pulled up to its track in Beijing, NO people there on the platform...

-- The Aizhai suspension bridge in Hunan (central) province, the bridge spans perhaps one kilometer, I counted EIGHT vehicles on that four lane bridge...

Of course Laing could be cherry-picking photos, but they are still compelling.

Laing brings in longtime China expert Kenneth Lieberthal (Brookings Institution) who again mentions that mal-invesments like duplication of facilities and fancy government buildings (that's a red flag). Much of this investment was made with relatively short-term loans coming due soon... And inadequate returns on those investments.

Laing then goes on to say that the well known problems of demographics (120 young men for every 100 young women, as well as the lesser known fact in 2015 the 15 - 24 year old cohort (entry level labor) will start a long-term decline) as well as the equally famous corruption problems (the "1%" there are sending out money as fast as they can steal it) are big problems that are not going away. Resentment is growing he writes...

Yet another expert Laing brings in (Peterson Institute economist Nicholas Lardy) who notes that last year residential construction accounted for 9.2% of the Chinese economy, compare that to OUR peak of 6% in 2006... Among major countries only Spain reached numbers like China's, and look what has happened there.

Author Bill Alpert writes on a closely related matter: the dangers of buying Chinese property developer stocks...

Yow! OK, OK, I will not be sending any money to China (except to buy some bearings).

***

Alan Abelson goes on to have some fun at the pundits' expense! Hey, I guessed wrong too, though. I was very surprised when I heard that the SCOTUS ruled that the individual mandate part of Obamacare was constitutional. At first that news dragged the Dow down 177 points, but that mostly was recovered by day's end. And Friday's news of a great new deal in Europe sent the Dow up over 270 points... Happy Days are here again!

Well, there were no details, but Abelson writes that we should be comforted by the chosen agents, with such comforting sounding names like the European Financial Stability Facility and the European Stability Mechanism...

He then goes on to write about Friday's upcoming JOBS NUMBER, which is the one getting the most attention nowadays (along with their almost always revised higher previous figures...).

Abelson finishes with remarks supporting Jonathan Laing's piece on China!

***

Michael Santoli ("Streetwise") presents a kind of bullish case for stocks summer, based on his view that many indicators are less scary than in 2011. No comment.

***

"The not noticed as much as it should have been" story of Stockton, California is mentioned on Page 12 ("Review & Preview", Page 12 my edition). It is the largest bankruptcy ever for a US city, both in population of the city and the amount of debt ($700 million).

"He Said":

"Our mission is clear: if we want to get rid of Obamacare, we're going to have to replace President Obama."

-- Mitt Romney on Thursday after SCOTUS gave Obama his political win (?)

***

Vito J. Racanelli writes of Fiat and Chrysler. Fiat owns 58.5% of Chrysler, and was kind-of brought in to save Chrysler you may recall (the other 41.5% of Chrysler is owned by an entity of the UAW, that should comfort you, ha!). Chrysler and Fiat CEO Sergio Marchionne has made some impressive strides with Chrysler now to the point where Fiat is now learning from them.

The first product of this marriage is the new Dodge Dart, the main problem with that (if it is even a good car...) is that it is going up against tough competition like the Honda Civic, the Toyota Corolla (disclosure: my wife LOVES her Corolla) and the Ford Focus.

Of even greater interest to me was the handy graph showing light vehicle (ie, not counting heavy trucks) sales of the top 12 manufacturers. I provide my own version of his data (which Racanelli sources from company reports), "click" on the image for a better view:

All other world manufacturers sold a total of 16.8 million vehicles (world total 76 million units).

I was kind of surprised that VW Group was Number One! Chinese vehicle sales must represent a large proportion of VW's vehicle sales.

***

Kopin Tan writes of the likely winners and losers in the wake of the SCOTUS Obamacare decision. Of the four sectors he writes the most about (Hospitals, Managed Care, Drug Makers and Medical Equipment), he sees it as a mixed bag (more customers but more regulations). He then writes that diagnostic and testing companies like Lab Corp (LH) and Quest (DGX) might do well as well as pharmacy chains like Rite-Aid (RAD).

***

"CEO Spotlight" this week features International Paper (IP) CEO John Faraci. IP has repaired itself! It was as low as under 8 in early 2009, it is back up to $27.89 way outperforming the S&P. IP now has a big joint venture in Russia (home to two-thirds of softwood trees), as well as a JV in India. But, not in China! They SELL to China. Faraci, recalling the advice of a friend: "You can't lose a lot of money in China unless you're there."

***

Tiernan Ray ("Technology Week") writes that the tech sector is getting pummeled. Short version: slow growth.

***

"Economic Beat" author Gene Epstein writes of the bad economics of Obamacare. He has actually studied the "Affordable Care Act" (Obamacare describes it much better than its official name). Here are some of Epstein's observations:

-- The young are subsidizing the elderly (so, it's not fair)

-- Obamacare bans insurance companies from NOT selling to people with pre-existing conditions. What this means is that there is no NEED for anyone healthy to buy insurance, just the fine (er, tax), and when something bad comes along re your health, THEN you buy the insurance!

-- The fine (tax!) will be $95 in 2014 and rises to $695 (or 2.5% of income, whichever is greater) by 2016

-- The good news is that the IRS will hire 10,000 more enforcers!

-- Once a firm has over 50 employees, the company is mandated to buy insurance... Hey, if I ran a company with about 49 employees, I would definitely NOT hire anyone...

***

Editor Thomas Donlan thinks that even if the Republicans win it all (President and Senate) they will be unable to undo Obamacare, at least in great part. Ugh! But, they will be able undo the fine/tax, repeal part of the Medicaid eligibility (Oh, my back hurts, and I'm poor), additional prescription drug benefits, etc., that fall under legislative budget rules and so do not need a 60 vote majority.

But, it looks like, according to Donlan, we are stuck with at least part of Obamacare from here on out.

***

In the Market Week section, there is not a whole lot that caught my interest, I guess they saved the "good stuff" (for me) in the China and Fiat-Chrysler articles.

Randall W. Forsyth ("Current Yield") notes that Treasury yields went back up in last week's "on risk" rally.

Kopin Tan (("Asian Trader') notes that Japan will likely raise its sales tax (consumption tax) from 5% to 10% gradually by October 2015. He goes on to note that Japanese stocks are down near their 2012 lows as exports weaken...

There were no BIG insider buys or sales last week, but two buys caught my eye.

"Commodities Corner" author Marshall Eckblad this weeks looks at the lean-hog market. Prices look like they will go down, as hog production is suffering to some degree because of the heat wave as well as China and South Korean production is up. An insider bought $299,000 worth of Schlumberger (SLB). ANother insider bought $249,000 worth of Sunoco Logistics Partners (SXL). By coincidence a very good friend of mine will soon start work with Sunoco Logistics.

The Mighty Peruvian Sol took a break from its recent strong performance vs. the US$, it declined about 0.5%, no sweat! Maybe my next haircut down there MIGHT JUST BE under $5.00...

Saturday, June 30, 2012

Thursday, June 28, 2012

Obamacare: Bad Medicine For America

I was as surprised as anyone when the Supreme Court failed to strike down the "Individual Mandate" (meaning that if you choose NOT to purchase health insurance, they whack you with a tax) part of Obamacare, and dismayed as well. I am not a constitutional layer, but it looks like the key for Chief Justice John Roberts to allow the Individual Mandate to become law is that the Mandate is indeed a tax... Although Obama & Co. emphatically declared that it was NOT a tax while they were pushing their odious program through Congress, they then declared before the Supreme Court that it was not an unconstitutional "penalty" but indeed a TAX. Obama & Co. saying it was not a tax while peddling this, then arguing before the Supreme Court it was a tax.

Hypocrites!

When I was young, they called this "talking out of both sides of your mouth". I cannot think of a better example of such hypocrisy.

***

Obamacare on so many levels is very bad program. Clocking in at well over 2000 pages, I should have included THIS in my article on complex things being dangerous. I wonder how many people have actually read it? Probably less than 1000 people. Whoever they were, they are likely very powerful people, or have lawyers do it for them.

***

The single main problem I have with Obamacare is that the whole gigantic grotesquerie pushes that much closer to a dictatorial government. Just days ago I wrote an article here on whether or not we are a Fascist State (short version: not yet). I will write more on this below, as I believe that this is another move by a big part of our Elite to impose their control over us.

There are many avenues to increased governmental control (they can access our medical data, deny us treatments, forces us into insurance schemes, may lead to schemes like monitoring and taxing our diets, dictate what a doctor can charge, etc.).

Obamacare is so complex that I cannot even think of more than the above (each of which is troubling), but what apparently will happen (if Obamacare is not stopped) is that each year will usher in tighter and tighter controls. Does that sound OK to you? More government controls? It does NOT sound OK to me.

So what bothers me (and many others) the most is the centralization of power to inflict further CONTROLS on our society. Get in line, bitchez!

***

Obama & Co. claim that Obamacare will save us money. Yes, that's what they say! Pretty brazen, no?

Gigantic government social programs NEVER save us money, they ALWAYS cost much more than advertised.

Obamacare will cost us trillions... Watch and see. Do not believe the Liars on the political left. Can ANYONE honestly argue that this president, who has added to the National Debt MORE than ALL the previous presidents put together, cares about saving money??? He does not. He is a liar.

***

Will Obamacare benefit the economy, as its backers claim? Please. Small businesses will hire fewer people and sack their health benefits packages.

Who will want to start a small business now?

Who will want to become a doctor now?

***

President Obama shows us more psychopathic tendencies than any other recent president I can think of. Worse than the much-hated George W. Bush.

***

I mentioned above (with the link) my article in The Fractured Elite being the main reason why we are not a fascist state yet.

My notion of a Fractured Elite may be given a test! In November we elect a president for the next four years. If Obama wins, and is somehow not restrained by Congress, then we can expect more "Obamacare-like things" to happen. More control, more hypocrisy. If Romney wins, then that will mark an important test of my hypothesis, that there ARE some differences between the Republicans and the Democrats. Romney just today announced that he would "repeal and replace" Obamacare starting on Day One.

If Romney does NOT work to undo Obamacare (and to undo much other damage done to us by the current president, especially in regards to cutting spending...), then I will have been proven wrong, that they have the same puppet-masters. What is voting worth if we cannot get change? Then what will I do?

I will go Galt.

Hypocrites!

When I was young, they called this "talking out of both sides of your mouth". I cannot think of a better example of such hypocrisy.

***

Obamacare on so many levels is very bad program. Clocking in at well over 2000 pages, I should have included THIS in my article on complex things being dangerous. I wonder how many people have actually read it? Probably less than 1000 people. Whoever they were, they are likely very powerful people, or have lawyers do it for them.

***

The single main problem I have with Obamacare is that the whole gigantic grotesquerie pushes that much closer to a dictatorial government. Just days ago I wrote an article here on whether or not we are a Fascist State (short version: not yet). I will write more on this below, as I believe that this is another move by a big part of our Elite to impose their control over us.

There are many avenues to increased governmental control (they can access our medical data, deny us treatments, forces us into insurance schemes, may lead to schemes like monitoring and taxing our diets, dictate what a doctor can charge, etc.).

Obamacare is so complex that I cannot even think of more than the above (each of which is troubling), but what apparently will happen (if Obamacare is not stopped) is that each year will usher in tighter and tighter controls. Does that sound OK to you? More government controls? It does NOT sound OK to me.

So what bothers me (and many others) the most is the centralization of power to inflict further CONTROLS on our society. Get in line, bitchez!

***

Obama & Co. claim that Obamacare will save us money. Yes, that's what they say! Pretty brazen, no?

Gigantic government social programs NEVER save us money, they ALWAYS cost much more than advertised.

Obamacare will cost us trillions... Watch and see. Do not believe the Liars on the political left. Can ANYONE honestly argue that this president, who has added to the National Debt MORE than ALL the previous presidents put together, cares about saving money??? He does not. He is a liar.

***

Will Obamacare benefit the economy, as its backers claim? Please. Small businesses will hire fewer people and sack their health benefits packages.

Who will want to start a small business now?

Who will want to become a doctor now?

***

President Obama shows us more psychopathic tendencies than any other recent president I can think of. Worse than the much-hated George W. Bush.

***

I mentioned above (with the link) my article in The Fractured Elite being the main reason why we are not a fascist state yet.

My notion of a Fractured Elite may be given a test! In November we elect a president for the next four years. If Obama wins, and is somehow not restrained by Congress, then we can expect more "Obamacare-like things" to happen. More control, more hypocrisy. If Romney wins, then that will mark an important test of my hypothesis, that there ARE some differences between the Republicans and the Democrats. Romney just today announced that he would "repeal and replace" Obamacare starting on Day One.

If Romney does NOT work to undo Obamacare (and to undo much other damage done to us by the current president, especially in regards to cutting spending...), then I will have been proven wrong, that they have the same puppet-masters. What is voting worth if we cannot get change? Then what will I do?

I will go Galt.

Tuesday, June 26, 2012

The Dangers of Complex THINGS

I just finished reading a book The Age of the Unthinkable by Joshua C. Ramo. The book highlights the need for different thinking to resolve complex problems we now see in the world today, and how the old ways of dealing with them are not serving us well. This book threw off a large number of ideas I am still trying to digest.

My great friend Ed sent me a link yesterday that provided the spark for writing this article. Thanks, Ed! Hey, Ed, you’re finally famous! The story is about an upgrade of an oil refinery (named the Motiva Refinery) in Port Arthur, Texas, to make this refinery the biggest in the USA. Note that there have been NO new refineries built in the USA in 30 years, and yet, we still have some over-capacity in oil refining. The interesting pair of thoughts in this story is how expensive it was to do this BIG upgrade and what happened, an accident:

A $10 billion project, and it looks like the owners (Royal Dutch Shell and Saudi Aramco) are going to have costs of over $1 billion for the accident. One small chemical spill caused this.

But, as we have all seen, all it takes is one small thing to shut down something very big… This article will be limited to discussing complex things, I will take up discussions of other complex matters (like the financial system and international relations) at another time.

***

The below are examples of complex THINGS where something went wrong and had big bad consequences (Black Swans in some cases):

n Ed’s refinery piece above

n Fukushima, Chernobyl and close calls re nuclear power plants

n The BP oil spill in the Gulf of Mexico

n The SuperSonic Transport plane killed in the early 1970s

n Major weapons systems

n The Space Shuttle

n The Super Collider project in Texas

n Stuxnet and complex software in general

I will now discuss each in turn.

It is worth your while (if you find this article interesting) to go and read about the refinery above. Because it is (was) the biggest in the USA, it is perhaps the most COMPLEX one as well. Size of a refinery does not necessarily correlate 100% with complexity, but I would be pretty sure that this would be right up there near No. 1 in complexity.

***

Nuclear power plants are inherently VERY complex. I have been told so by a physicist I know. It is very tricky handling all the moving parts… The people running the plants must be well-trained and alert at all times. We have had two disasters with nuclear power plants and an almost-disaster right here in the USA (Three Mile Island, back around 1979 or so). Fukushima and Chernobyl can both be classified as real live Black Swans. OK, yes, building nuclear power plants along seismic fault lines should have been seen as an error, but we have nuclear power plants built along fault lines in California and in flood plains (remember the nuclear power plant that was almost flooded not too long ago in Nebraska I believe?). I have to believe that other nuclear power plants have been built in other areas that are not well chosen (there is one less than 40 miles north of New York City).

Fukushima has caused an enormous dislocation in Japan. They cannot adequately re-settle the population dispersed from the Fukushima area, there is no spare land available in Japan. It will take trillions of dollars to clean up the mess. Who knows what the likely health effects ARE already among the effected population? If things get worse, will they try to evacuate TOKYO? Where would the 30,000,000 people go? (My answer: let a bunch of the best of them into the USA!). What if the dire scenarios happen (the control rods catch fire and spread radioactive plutonium all over the Northern Hemisphere)?

Chernobyl caused death counts believed to be in the 100,000s. It caused birth defects and other health problems among the living. The immediate area around Chernobyl (northern Ukraine now) is too radioactive to be habitable.

And my reading says that we came “this close” to a BIG problem at Three Mile Island. There have been a number of near misses at other US nuclear power plants as well. I n recent years there was a set of problems at a plant in Toledo, Ohio that almost had BIG problems because of the regional electrical blackout.

***

Another disaster happened in great part due to being very complex. BP was drilling an offshore oil well in deep water to a very great depth below the bottom of the Gulf there (the infamous Macondo well). Drilling in deep water has its own set of special engineering challenges, I worked (briefly) on offshore rigs as a young guy, so I know this to be true. And drilling deep holes also has its own separate challenges. Here we got both.

BP was drilling in this challenging environment and was considered a little “sloppy” by other oil company standards. Save a buck here, speed up drilling there, cut some corners elsewhere. This kind of thinking is very dangerous in environments that are complex and where the consequences of a blowout were very high. Something like 20 lives were lost and a HUGE amount of oil came spewing into the Gulf. If the drilling and production had gone as planned, this would have been considered a major discovery. Lots of oil at very high pressure, a great discovery if everything had been done right and gone according to plan.

Instead, a number of small things went wrong (including modifications of the blowout preventers, a crew not paying attention, BP’s pressure on Transocean to “make hole”, etc.) led to this disaster. All of this is still being fought out in court, and we still do not understand the total environmental damages… My lil ol suspicious mind would tell me that they are still lying to us. I have at least one friend who will not eat any seafood from the Gulf of Mexico.

***

As a young space cadet teenager in the early 1970s, I was dismayed when I heard the news that the SuperSonic Transport plane (to be bigger and better than the Anglo-French Concorde) was killed. This was another extremely complicated machine… It ran WAY over budget… Seeing how the Concorde turned out to be a big waste of money for France and England, I am sure that killing the project then saved many billions of dollars for a plane of dubious worth.

***

In a very similar way, we see the same in major weapons systems. “Everybody” wants to have the best weaponry to destroy our enemy’s weapons should it come to that. Technological change forces our military to have to upgrade different weapon systems every now and then (time period varies depending on the weapon). Even relatively uncomplicated things can get expensive and be of dubious value (eg, the M-16 automatic rifle when first introduced in Viet Nam). Here is a list of major Defense Department projects with huge cost overruns:

The F-22 fighter, a bad plane my pilot friend tells me

The planned F-30 fighter, even worse

The C-17 transport plane, running WAY over budget and of limited use

Aircraft Carriers, are these worth it if the Chinese (or Iranians) can sink them?

The Osprey (vertical take-off plane that the Marines decided they did not want)

Almost all new helicopter projects cost too much.

The list goes on, but my expertise is limited. Of course, almost ANYTHING the Pentagon gets involved with, almost “by definition” now, becomes MUCH more expensive than planned on. This would be par for the course with the military-industrial complex.

***

Again in a similar way we had our Space Shuttle project. We lost two of them, one via a bad rocket (frozen O-ring), the other with heat tiles peeling off. The Space Shuttle was a very complex piece of equipment, and it is not clear to me if we benefited or not with this program.

There is no follow-on program to getting us back into space.

***

Yet another tremendously complex thing was the abandoned Super Collider project in Texas. This was to be the world’s most powerful particle accelerator. I believe the circular ring was seven miles in diameter. The idea was to have this huge machine move particles and smash them together at such high speeds as to better learn more about sub-atomic particles and the rules of the universe at a very small scale. The project was killed because of its high cost.

The Europeans already have a pretty big one along the French-Swiss border (CERN). Bully for them.

***

Finally, although arguably not a thing, is complex software. The “Stuxnet” virus we (and/or the Israelis) unleashed on Iran is something which may have a big blowback… Stuxnet, no doubt, is now being looked at by China (et al) for eventual recycling into the USA.

In general, complicated software is prone to bugs, which are often VERY difficult to eradicate…

In addition, complex software can often yield incorrect results. This too could be considered dangerous. Who knows what kinds of bugs lurk in (for example) aircraft control software in the newest “fly by wire” airplanes? Or drones?

***

And these are just THINGS! The complexity of the above things pales beside the complexities of the financial markets, international relations and challenges of understanding the environmental and ecological systems we live in. Perhaps I will look into those in future articles.

Saturday, June 23, 2012

Review of Barron's -- Dated 25 June

It was a gloomy day here, and yet with lots for me to do. Well, after reading this issue of Barron’s, I went and did some Tai Chi, so at least some good things happened today… We did watch two episodes of “Dexter” as well, so the day turned out OK.

And before I get started, I offer up TWO Challenges to my readers! You can win $5.00 (each Challenge, first one to email me wins) of Robert’s money by correctly identifying two things: a word in THIS Review with all five vowels and the interesting thing to be found in the Delaware Investments ad (page 26 of my edition), you have to really LOOK CLOSELY and think outside the box to get the latter, not to mention actually have to buy or read Barron’s… Winners would have to supply me a mailing address for the $5.00.

***

The Cover Story (“World’s Most Respected Companies”) immediately captivated me, so it was not hard for me to part with my $5.00 (plus sales tax). Author Michael Santoli writes of their procedure: they surveyed about 116 investors / money managers to rate each of the 100 largest companies in the world (by market capitalization as of April 13). A point value (1 – 4) was given by each to the four ratings (Don’t Respect – Highly Respect, 4 being highly respect) to each company. The responders are mostly American, so this does tilt the field towards the American companies, but it always HAS before. But, it is even a little bit more skewed this year Santoli writes. I list off the Top 10 most respected companies by Barron’s methodology:

1) Apple (AAPL) ß by a LOT over No. 2 (AAPL No. 1 last year as well)

2) IBM (IBM, No. 4 last year)

3) McDonald’s (MCD, No. 5 last year)

4) Amazon.com (AMZN, No. 2 last year)

5) Caterpillar (CAT, NR last year ß What? Not rated?)

6) 3M (MMM, No. 7 last year)

7) United Parcel Service (UPS, No. 13 last year)

8) Coca-Cola (KO, No. 8 last year)

9) Nestle (NESN, Switzerland, No. 19 last year)

10) Intel (INTC, No. 17 last year)

FYI, the bottom five:

96) American International Group (AIG, NR last year, what a surprise)

97) China Construction Bank (China / 939, No. 94 last year

98) Ecopetrol (Colombia / EC, No. 93 last year) ß Barron’s recently had a positive piece on Ecopetrol

99) Sberbank Rossia (Russia / SBRCY, No. 99 last year)

100) Gazprom (Russia / OGZPY, No. 100 last year)

Companies that had problems or whiffs of scandals went down a lot. Ethical breaches (JP Morgan from No. 14 last year to No. 49 (respect) and unpopular political stances (Berkshire-Hathaway, from No. 3 to No. 15). Wal-Mart Stores and Pepsico also had big drops. TBTF banks Citigroup (No. 91) and Bank of America (No. 94) did not come out well either.

Other companies of note:

Walt Disney (No. 11 this year, No. 12 last year)

ExxonMobli (No. 12 this year, No. 11 last)

Google (No. 16 this year, No. 6 last)

Microsoft (No. 19 this year, No. 22 last)

***

Alan Abelson continues to be amazed by Ben, the Master Magician, who managed to put the rabbit back into the hat… Bernanke and Co. came out with a relatively disappointing same old, same old Twist. And scaring away investors the next day with a 250 point price plunge. He wonders WHAT it would take to get the Fed to do something big (Dow at 800?). He offers up the notion that Bernanke might be playing a little hardball with Congress, to get them to fix the budget… Abelson thinks the Fed should have done more [Ed. note: not me!], or maybe that Fed is out of bullets [Ed. note: they still have a few they can fire in July or September].

He then goes on to write that a Bloomberg poll found that Americans favored sitting next to Obama (57%) vs. Romney (31%) on their next long flight. Frivolous? It could be worse. In Mexico the presidential candidates include a Hitler admirer, a self-confessed adulterer and ex-Playboy model. Uh, OK.

Abelson then finishes with comments on the Moody’s bank downgrades and the situation in China and Europe. He then tells us that the latest edition of the “Bank Credit Analyst” predicts gold will go down as it did in 2008. Abelson disagrees…

***

Michael Santoli (they keep their writers busy over there) writes in “Streetwise” that crude coming down and the wringing out of excessive pessimism re Europe has held the market up pretty well. He thinks that may be ending…, that the next moves might be down. He also notes that certain specialty retailers are down (LULU, FOSL, BBBY) and are vulnerable to the slightest bad news (Tractor Supply (TSCO)), which has grown a LOT in recent years, but may be in danger of disappointing…

***

“He Said”:

“We don’t gamble. We do make mistakes.”

Jamie Dimon, CEO of JP Morgan, testifying on Capitol Hill

(Barron’s needs to find people other than Dimon, Bernanke, and Soros to quote)

***

Andrew Bary writes “TARP’s Last Stand”, in which he says that one of the last pieces of TARP business not completed is the Treasury’s task of selling all the Preferred Stock in smaller banks that they still own. He writes that if you do your homework right that you can make double-digits on these preferreds… I dunno, I had not EVEN HEARD of any of the seven banks… And I would not trust my homework on them…

***

Jonathan R. Laing writes a bullish piece on Corrections Corp. of America (CXW), the company that houses some 80,000 inmates in their facilities in 20 states. The company has lots of unfilled beds, but they have reason for hope, they are about to offer cash upfront to municipalities and states to allow them to run their prisons (at a lower cost). CXW might also turn itself into a REIT, which would probably offer a nice big dividend.

***

Tiernan Ray (“Technology Week”) writes about the various moving parts of Microsoft’s brand-new foray into tablet computers. But, this of course will aggravate two of MSFT’s own big customers (Hewlett-Packard and Dell). But, Microsoft feels like it has to do something to stay in the game vs. Apple, which is cleaning everyone’s clocks with iPads and iPhones (our daughter owns both iDevices).

***

For the second time in a month, Barron’s features a money manager who likes Japan, this time Toru Hashizume, who runs a hedge fund there. He sells short, avoids big multi-nationals and hunts for bargains. For example, he avoids Honda Motor, as Hyundai of Korea now has technology on par with Honda, and Hyundai’s cars cost less. [Ed. note, as a buyer of Korean bearings I would urge everyone to go look at Hyundai…).

***

Lawrence C. Strauss interviews Randy Heck and Bradley Purcell of the Goodnow Investment Group. They have four picks:

Polypore International (PPO, a maker of membranes and filters, which is fairly heavily shorted, incorrectly so in their view), NeuStar (NSR, this company provides addressing and routing for every single phone call and every text message in the USA, it was founded in 1996 from AT&T), Green Mtn Coffee Roasters (GMCR, they apparently dominate single-serve coffee) and Vistaprint (VPRT, which provides marketing materials and tools for small businesses). [I might go with PPO (barriers to entry) and NSR (same) if I had to pick two]

***

Jim McTague, their Washington, DC pro, writes that the US Navy experiment to use lots of biofuels looks to be a turkey program (gobble-gobble). Big surprise. While there ARE some proponents of using US-produced biofuels (very expensive though), it looks like the drawbacks outweigh the plusses… Big maritime shipper Maersk (Denmark) has ruled out a “Green Fleet” because of high cost. And the US Navy would not be able to refuel with biofuels in faraway ports, you know, where the ships might actually go into combat.

***

I was pleased to see one of the letters written To the Editor (“Mailbag”). FINALLY someone else takes note that the last two times the “investment pros” offered up their advice, their returns were LOWER than the S&P 500. THANK YOU, Maxine Blumberg (and of course Barron’s for publishing it)!

***

Editor Thomas Donlan (this time I checked to see it was him…). Donlan writes that California's pension systems are in so much trouble that the state wants to expand them. He mentions that one of the definitions of insanity is doing the same thing over and over, and expecting a different results. So, California wants the private sector to have a pension system like the state's? Gov. Jerry Brown MIGHT veto that one...

Donlan goes on to write that the eurovians (eurovians?, I guess those would be Europeans who use the euro) list their action points, but with no specifics. Ah, nothing new under the sun here either!

***

In the Market Week section, Vito J. Racanelli, Andrew Bary and Kopin Tan write that investors were disappointed that the Fed did not do much, that is their explanation of why stocks went down about 1% last week. They finish their piece with the only discussion of guar gum I have ever seen. What is guar gum? It is derived from a bean grown in India and is an important additive used in the hydraulic-fracking fluids in the oil services business. Guar gum prices are high now, and prices won't ease much until new production comes in 2013. This will somewhat affect profits of Halliburton (HAL), Baker Hughes (BHI) and C&J Energy Services (CJES). Just thought I'd give you a heads-up guys...

First Solar makes its second recent appearance on "Charting the Market". Los Angeles will now permit the company to resume work on its huge solar power farm.

Jonathan Buck ("European Trader") suggests that we consider investing in mostly the UK and Germany as relatively safe places. The UK is out of the euro-zone (and so, I suppose, they are not "eurovians") while German exports would go up on a euro decline. [Ed. note, no thanks even for Germany and the UK]

Kopin Tan ("Asian Trader") suggests that big Chinese offshore oil producer CNOOC (ticker: 883.Hong Kong) looks cheap now. IIRC, CNOOC seems to be well run, but...

Tatyana Shumsky writes the edition of "Commodities Corner" and is about lithium. Lithium is used in high-powered batteries for cellphones and laptops (and for electric cars too I believe). Demand for lithium is expected to increase 20% + per year. Lithium pricing is opaque she writes, it is not traded on any exchanges and lithium is sold in various salt forms or as a metal with special specifications. The way to play lithium would be to look at the four major producers: Talison Lithium (TLH.Canada), Rockwood Holdings (ROC) -- these two vie for the top spot in producing, and Sociedad Quimica y Minera (SQM) and FMC (FMC). There is an ETF for lithium if you want broad exposure (probably a good idea): Global X Lithium ETF (LIT). Nice article Tatyana!

Donlan goes on to write that the eurovians (eurovians?, I guess those would be Europeans who use the euro) list their action points, but with no specifics. Ah, nothing new under the sun here either!

***

In the Market Week section, Vito J. Racanelli, Andrew Bary and Kopin Tan write that investors were disappointed that the Fed did not do much, that is their explanation of why stocks went down about 1% last week. They finish their piece with the only discussion of guar gum I have ever seen. What is guar gum? It is derived from a bean grown in India and is an important additive used in the hydraulic-fracking fluids in the oil services business. Guar gum prices are high now, and prices won't ease much until new production comes in 2013. This will somewhat affect profits of Halliburton (HAL), Baker Hughes (BHI) and C&J Energy Services (CJES). Just thought I'd give you a heads-up guys...

First Solar makes its second recent appearance on "Charting the Market". Los Angeles will now permit the company to resume work on its huge solar power farm.

Jonathan Buck ("European Trader") suggests that we consider investing in mostly the UK and Germany as relatively safe places. The UK is out of the euro-zone (and so, I suppose, they are not "eurovians") while German exports would go up on a euro decline. [Ed. note, no thanks even for Germany and the UK]

Kopin Tan ("Asian Trader") suggests that big Chinese offshore oil producer CNOOC (ticker: 883.Hong Kong) looks cheap now. IIRC, CNOOC seems to be well run, but...

Tatyana Shumsky writes the edition of "Commodities Corner" and is about lithium. Lithium is used in high-powered batteries for cellphones and laptops (and for electric cars too I believe). Demand for lithium is expected to increase 20% + per year. Lithium pricing is opaque she writes, it is not traded on any exchanges and lithium is sold in various salt forms or as a metal with special specifications. The way to play lithium would be to look at the four major producers: Talison Lithium (TLH.Canada), Rockwood Holdings (ROC) -- these two vie for the top spot in producing, and Sociedad Quimica y Minera (SQM) and FMC (FMC). There is an ETF for lithium if you want broad exposure (probably a good idea): Global X Lithium ETF (LIT). Nice article Tatyana!

Randall W. Forsyth ("Current Yield") notes that the new Twist did not bring rates any lower... Shooting blanks now Ben?

There was no huge ($30 million or more) action among insiders last week, but there was one item of interest to me: two insiders at Molycorp (MCP, the rare-earths miner I have discussed various times here at my blog) BOUGHT $350,000 worth of stock. Veyron! I have now given you TWO trading ideas, both times positive news has come out since, you know where to send me the check...

The Mighty Peruvian Sol continues to push its way higher vs. the hapless US$ (and everything else I guess), the Sol was up another 1% last week. I guess all my haircuts down there will soon have a "5 dollar" handle now...

There was no huge ($30 million or more) action among insiders last week, but there was one item of interest to me: two insiders at Molycorp (MCP, the rare-earths miner I have discussed various times here at my blog) BOUGHT $350,000 worth of stock. Veyron! I have now given you TWO trading ideas, both times positive news has come out since, you know where to send me the check...

The Mighty Peruvian Sol continues to push its way higher vs. the hapless US$ (and everything else I guess), the Sol was up another 1% last week. I guess all my haircuts down there will soon have a "5 dollar" handle now...

Thursday, June 21, 2012

Making Simple Models With Two Math Functions

I am currently reading a book (The Age of the Unthinkable, by J. C. Ramo) that in parts discusses how limited mathematical models are in replicating and studying complex systems. Economists (and many others) have been building models to help explain many things: our economy, movements in the financial markets, international relations and many other things. The math behind these models can be very complex, and yet many of these models make bad assumptions and do not take "surprises" into account.

Many newer models are evolving into towards "probabilistic" models, that is, models that take in to account that various outcomes.

In this article, I will discuss using two closely related mathematical functions that make useful (if limited, and limited to simple systems). They are the "y = ln(x)" and the "y = e^x" (aka y = exp(x) or "e to the x-power"). Much of this discussion is based in part from two of my earlier articles (http://robertmixblog.blogspot.com/2012/01/exponential-growth.html and http://robertmixblog.blogspot.com/2012/03/marginal-utility-and-gold.html).

***

I have "copied & pasted" the below, the heart of my "Exponential Growth" article. These graphs model inflation and growth of the US National Debt.

[clip]

All my graphs and comments below are not the exact numbers (which would be disputed anyway), but are close enough to make the lessons clear.

This first graph illustrates what happens in a constant 3% inflation from 1913 - 2012. 3% is close to the average rate of inflation since 1913, but is NOT the correct figure, but it is close enough. A hammer that cost $1.00 in 1913 would cost over $18.00 today, given that 3% inflation (blue series data points). The red data points show a 3 cent (not 3%!) fixed increase each year. I put the "red" data in because that would be what would have been PERCEIVED by a hammer buyer looking at a price change over a year or two (at least for the early years). CLICK on any of the graphs for a better view.

The next chart is "kind of the inverse (1/e^x, which I believe is also the "exponential distribution")" of the above and may be more familiar looking. It shows the value of the dollar falling vs. the 1913 dollar. Most researchers who have prepared a similar graph to the below usually arrive at a final end point of the 2012 dollar being only worth 3 cents. In my case here (using a constant 3% inflation), the dollar has fallen in value from 1913 - 2012 to about 4 - 5 cents:

Again, I picked a close to 3% inflation as "about right" for the period 1913 - 2012, so my graph and end result is different than what other researchers have put out there (again, this for educational purposes here).

This next graph extends the first graph out to the year 2032 (twenty years from now). You may be thinking two things:

1) 20 years, that's a long time. My response, look how the last 20 years have flown by...

2) That curve doesn't look so bad. My response, please look at the vertical scale, a $34 hammer in 2032 vs. $18 now...

The red data points are the same, a three cent increase each year.

The next graph is an extension out to 2062. Yes, I know that it is unlikely that we will see 3% constant inflation from now until then AND that 2062 is a year for our grandchildren, but it illustrates well what happens in "the out years" (note that the $1.00 1913 hammer is now over $80):

I now turn our attention to the US National Debt, a current figure that is in the Debt Widget above. Again, this debt widget throws off a number which is different than the approx. $15.2 trillion typically seen elsewhere, but it certainly close enough. The below graph shows what would happen if we allowed our national debt to grow at 11%, which by some rough-and-ready calculation is what I derive from 2007 until now. This 11% growth is probably conservative (low) for the interval since 2007, and would be much disputed, but it is at least approximately right and useful enough to illustrate our plight. Note that our debt would be at over $70 trillion dollars by 2026, a mere 14 years away (a mere 14 years for long-term thinkers anyway!). Note that I started with 2007 debt at $9.8 trillion, it has grown a little faster up through today than my graph shows (that's why I said recent growth in our debt of 11% is likely conservative = a low growth rate).

In the next graph I extend the time frame out some more to 2036:

We would have a $200 trillion dollar national debt in 2036. Obviously that is not going to happen, unless we hyperinflate. But, it is HARD for politicians to stop spending, so a scenario like the above (11% growth of national debt) is possible even if very unlikely. Predicting things out to 2036 is really a fool's chore, I just illustrate here what would happen given 11% growth in the debt, even if this scenario will not happen.

Let's play pretend one last time (or have a "Thought Experiment" for finicky adults who do not like to play). "Let's say" that in a moment of relative panic and seriousness that our politicians in 2017 (after Obama's second term or after Romney's first term) decide to get "really serious" about our debt. I mean it, really serious! And, let's say they are SO serious that they decide limit the growth of government debt by 5% per year (as the looming debt growing at 11% is starting to look scary even for politicians...). They are SO SERIOUS that they get a Constitutional Amendment through limiting growth of the debt to 5% a year! Wow! That's pretty serious! Well, that sounds pretty good, doesn't it? And 5% is not so much, no? Just a little bit over our projected economic growth rate. Hallelujah! Hallelujah!

Well, let's see:

Mmm. In studying this one, we see the debt still going up at a 5% rate after 2017. Look carefully at the "kink" in the graph in the year 2017 (just after the "2015" label). The curve then grows markedly less steeply than just before in 2014, 2015 and 2016. But, take another look at 2036 (when a lot of us may still be alive), the debt has grown to over $70 trillion.

[/clip]

***

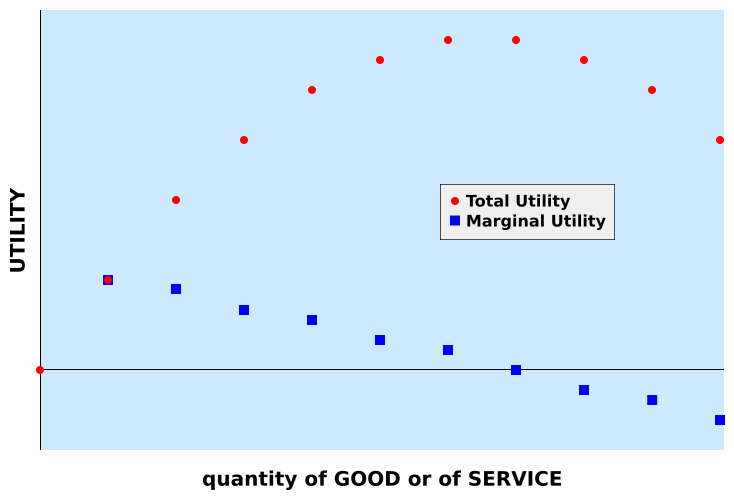

The below is a similar clip from my "Marginal Utility And Gold" article. In that article I discuss "marginal utility", an economic term with how much you enjoy the next purchase of something that you enjoy, "units of happiness or satisfaction" if you will.

[clip]

Let's do one of my beloved "Thought Experiments" here to explore this graph. "Let's say" you are the head of a happy household with FIVE CHILDREN (are you reading this Amy?), and let's also say that you just won a decent amount of money from your local lottery (say $1,000,000 free and clear, in cash now, taxes already paid). Let's also assume that you are middle class, not deep in debt and have your retirement money put aside OK. So, you are free to spend the money!

You determine that your major purchases are to be to upgrade your transportation, you deserve it, so why not? So, before you head out the door, you are at the very beginning of the above graph. You decide to buy a BMW! Wow, that felt good, didn't it? You are now at that next point on the graph, shared by the blue square and the red dot. The Y-axis is your "utility", how good you feel being a BMW owner. You got a nice chunk of utility from buying the car. So, you decide to buy your wife as well! Smart move, she is likely to be very happy too. Now, take a close look at the graph to see WHAT it is charting. The red dots are your TOTAL happiness (utility) from buying the two (for now) cars. The blue squares show your marginal utility, that is how much EXTRA pleasure you got from your most recent purchase. You will note you got almost as much pleasure from buying that second car as from the first. That is still pretty good though.

You then decide that your oldest child gets to have a BMW as well, s/he's a good kid, right? So you buy BMW number three. But, to be fair, you decide to buy EACH one of your children in turn a new BMW. At this point, you are probably not getting any extra happiness from that seventh car! And THAT is where the blue square is there at zero (no extra happiness) and the red dots are as high as they are going to go. Let's say you buy yet another BMW... You will likely NOT derive any utility here, in fact, if this Thought Experiment follows this graph, you would LOSE utility (be LESS happy) because where are you going to park that eighth car...?

Most products and services are like this. If you like Big Macs, that first one is yummy! The second will likely fill you up, that is likely to be as much as you want (maximum utility). The third Big Mac would likely make you sick...

***

But, gold is different. I mentioned near the very top of this article that I responded to two new buyers of precious metals. I told them both that AT LEAST FOUR TIMES that I had reached a convenient "round number" of ounces of gold that I wanted to hold, and that would be that. I would not need anymore. But, soon thereafter, I found that, well yes, that I could buy just a little bit more gold.

In other words, at least four times I thought that I would have enough gold to keep me happy only to find I wanted more...

So, gold would NOT follow the above graph from wikipedia. My best guess is that gold would follow a path similar to the "y = ln(x)" curve. Where the Y-axis is total utility and the X-axis increasing gold ownership through time. The ln(x) curve is the INVERSE of the exponential curve (the e^x, "e to the x power"). There are two graphs below, the first one is ln(x) up to 500 oz of gold owned and showing a "utility" of about 6.1. The second graph shows ln(x) out to 5000 ounces, with a utility of about 8.2.

Three quick notes about the above two graphs. The first is that I put in "Y-axis" values below zero because that is the actual way the ln(x) curve is. Secondly, note each unit of "utility" is worth a LOT (5000 oz of gold is approximately 206 lbs of gold, troy ounces remember)! Third, take a good look at the SHAPE of the two curves, they are essentially identical! They scale exactly the same, just like the more well known exponential curve. If I am interpreting this right, marginal utility of increased gold holdings scales very nicely all the way up the curve!

[/clip]

***

I mentioned up there in the exponential growth part that the inverse of e^x is the 1/e^x, the traditional way that we non-math majors think of the inverse ("one over (the function)").

There is another way to think about y = e^x and y = ln(x) however. These two functions are the inverse of each other in another way. They are mirror images of each other about the "y = x line". See below graph:

The blue diamonds above are "y = exp(x)", the red squares are "y = ln(x)" and the green triangles are "y = x". Note that ln(x) and exp(x) do indeed mirror-image each other off of the "y = x" line. Pick a convenient value of y or x (say 15), and note that the distance from (15,15) to each curve is the same (I leave proof of this as an exercise for the reader).

The exponential function is well known for modeling many phenomena. I have to think that its inverse, the natural logarithm should model some things we see as well.

***

Here is a blog link to a guy writing on kind-of similar pieces as the above. It is worth your while to take a look:

https://pearlsforswine.wordpress.com/

Many newer models are evolving into towards "probabilistic" models, that is, models that take in to account that various outcomes.

In this article, I will discuss using two closely related mathematical functions that make useful (if limited, and limited to simple systems). They are the "y = ln(x)" and the "y = e^x" (aka y = exp(x) or "e to the x-power"). Much of this discussion is based in part from two of my earlier articles (http://robertmixblog.blogspot.com/2012/01/exponential-growth.html and http://robertmixblog.blogspot.com/2012/03/marginal-utility-and-gold.html).

***

I have "copied & pasted" the below, the heart of my "Exponential Growth" article. These graphs model inflation and growth of the US National Debt.

[clip]

All my graphs and comments below are not the exact numbers (which would be disputed anyway), but are close enough to make the lessons clear.

This first graph illustrates what happens in a constant 3% inflation from 1913 - 2012. 3% is close to the average rate of inflation since 1913, but is NOT the correct figure, but it is close enough. A hammer that cost $1.00 in 1913 would cost over $18.00 today, given that 3% inflation (blue series data points). The red data points show a 3 cent (not 3%!) fixed increase each year. I put the "red" data in because that would be what would have been PERCEIVED by a hammer buyer looking at a price change over a year or two (at least for the early years). CLICK on any of the graphs for a better view.

The next chart is "kind of the inverse (1/e^x, which I believe is also the "exponential distribution")" of the above and may be more familiar looking. It shows the value of the dollar falling vs. the 1913 dollar. Most researchers who have prepared a similar graph to the below usually arrive at a final end point of the 2012 dollar being only worth 3 cents. In my case here (using a constant 3% inflation), the dollar has fallen in value from 1913 - 2012 to about 4 - 5 cents:

Again, I picked a close to 3% inflation as "about right" for the period 1913 - 2012, so my graph and end result is different than what other researchers have put out there (again, this for educational purposes here).

This next graph extends the first graph out to the year 2032 (twenty years from now). You may be thinking two things:

1) 20 years, that's a long time. My response, look how the last 20 years have flown by...

2) That curve doesn't look so bad. My response, please look at the vertical scale, a $34 hammer in 2032 vs. $18 now...

The red data points are the same, a three cent increase each year.

The next graph is an extension out to 2062. Yes, I know that it is unlikely that we will see 3% constant inflation from now until then AND that 2062 is a year for our grandchildren, but it illustrates well what happens in "the out years" (note that the $1.00 1913 hammer is now over $80):

I now turn our attention to the US National Debt, a current figure that is in the Debt Widget above. Again, this debt widget throws off a number which is different than the approx. $15.2 trillion typically seen elsewhere, but it certainly close enough. The below graph shows what would happen if we allowed our national debt to grow at 11%, which by some rough-and-ready calculation is what I derive from 2007 until now. This 11% growth is probably conservative (low) for the interval since 2007, and would be much disputed, but it is at least approximately right and useful enough to illustrate our plight. Note that our debt would be at over $70 trillion dollars by 2026, a mere 14 years away (a mere 14 years for long-term thinkers anyway!). Note that I started with 2007 debt at $9.8 trillion, it has grown a little faster up through today than my graph shows (that's why I said recent growth in our debt of 11% is likely conservative = a low growth rate).

In the next graph I extend the time frame out some more to 2036:

We would have a $200 trillion dollar national debt in 2036. Obviously that is not going to happen, unless we hyperinflate. But, it is HARD for politicians to stop spending, so a scenario like the above (11% growth of national debt) is possible even if very unlikely. Predicting things out to 2036 is really a fool's chore, I just illustrate here what would happen given 11% growth in the debt, even if this scenario will not happen.

Let's play pretend one last time (or have a "Thought Experiment" for finicky adults who do not like to play). "Let's say" that in a moment of relative panic and seriousness that our politicians in 2017 (after Obama's second term or after Romney's first term) decide to get "really serious" about our debt. I mean it, really serious! And, let's say they are SO serious that they decide limit the growth of government debt by 5% per year (as the looming debt growing at 11% is starting to look scary even for politicians...). They are SO SERIOUS that they get a Constitutional Amendment through limiting growth of the debt to 5% a year! Wow! That's pretty serious! Well, that sounds pretty good, doesn't it? And 5% is not so much, no? Just a little bit over our projected economic growth rate. Hallelujah! Hallelujah!

Well, let's see:

Mmm. In studying this one, we see the debt still going up at a 5% rate after 2017. Look carefully at the "kink" in the graph in the year 2017 (just after the "2015" label). The curve then grows markedly less steeply than just before in 2014, 2015 and 2016. But, take another look at 2036 (when a lot of us may still be alive), the debt has grown to over $70 trillion.

[/clip]

***

The below is a similar clip from my "Marginal Utility And Gold" article. In that article I discuss "marginal utility", an economic term with how much you enjoy the next purchase of something that you enjoy, "units of happiness or satisfaction" if you will.

[clip]

From Wikipedia, the free encyclopedia

Let's do one of my beloved "Thought Experiments" here to explore this graph. "Let's say" you are the head of a happy household with FIVE CHILDREN (are you reading this Amy?), and let's also say that you just won a decent amount of money from your local lottery (say $1,000,000 free and clear, in cash now, taxes already paid). Let's also assume that you are middle class, not deep in debt and have your retirement money put aside OK. So, you are free to spend the money!

You determine that your major purchases are to be to upgrade your transportation, you deserve it, so why not? So, before you head out the door, you are at the very beginning of the above graph. You decide to buy a BMW! Wow, that felt good, didn't it? You are now at that next point on the graph, shared by the blue square and the red dot. The Y-axis is your "utility", how good you feel being a BMW owner. You got a nice chunk of utility from buying the car. So, you decide to buy your wife as well! Smart move, she is likely to be very happy too. Now, take a close look at the graph to see WHAT it is charting. The red dots are your TOTAL happiness (utility) from buying the two (for now) cars. The blue squares show your marginal utility, that is how much EXTRA pleasure you got from your most recent purchase. You will note you got almost as much pleasure from buying that second car as from the first. That is still pretty good though.

You then decide that your oldest child gets to have a BMW as well, s/he's a good kid, right? So you buy BMW number three. But, to be fair, you decide to buy EACH one of your children in turn a new BMW. At this point, you are probably not getting any extra happiness from that seventh car! And THAT is where the blue square is there at zero (no extra happiness) and the red dots are as high as they are going to go. Let's say you buy yet another BMW... You will likely NOT derive any utility here, in fact, if this Thought Experiment follows this graph, you would LOSE utility (be LESS happy) because where are you going to park that eighth car...?

Most products and services are like this. If you like Big Macs, that first one is yummy! The second will likely fill you up, that is likely to be as much as you want (maximum utility). The third Big Mac would likely make you sick...

***

But, gold is different. I mentioned near the very top of this article that I responded to two new buyers of precious metals. I told them both that AT LEAST FOUR TIMES that I had reached a convenient "round number" of ounces of gold that I wanted to hold, and that would be that. I would not need anymore. But, soon thereafter, I found that, well yes, that I could buy just a little bit more gold.

In other words, at least four times I thought that I would have enough gold to keep me happy only to find I wanted more...

So, gold would NOT follow the above graph from wikipedia. My best guess is that gold would follow a path similar to the "y = ln(x)" curve. Where the Y-axis is total utility and the X-axis increasing gold ownership through time. The ln(x) curve is the INVERSE of the exponential curve (the e^x, "e to the x power"). There are two graphs below, the first one is ln(x) up to 500 oz of gold owned and showing a "utility" of about 6.1. The second graph shows ln(x) out to 5000 ounces, with a utility of about 8.2.

Three quick notes about the above two graphs. The first is that I put in "Y-axis" values below zero because that is the actual way the ln(x) curve is. Secondly, note each unit of "utility" is worth a LOT (5000 oz of gold is approximately 206 lbs of gold, troy ounces remember)! Third, take a good look at the SHAPE of the two curves, they are essentially identical! They scale exactly the same, just like the more well known exponential curve. If I am interpreting this right, marginal utility of increased gold holdings scales very nicely all the way up the curve!

[/clip]

***

I mentioned up there in the exponential growth part that the inverse of e^x is the 1/e^x, the traditional way that we non-math majors think of the inverse ("one over (the function)").

There is another way to think about y = e^x and y = ln(x) however. These two functions are the inverse of each other in another way. They are mirror images of each other about the "y = x line". See below graph:

The blue diamonds above are "y = exp(x)", the red squares are "y = ln(x)" and the green triangles are "y = x". Note that ln(x) and exp(x) do indeed mirror-image each other off of the "y = x" line. Pick a convenient value of y or x (say 15), and note that the distance from (15,15) to each curve is the same (I leave proof of this as an exercise for the reader).

The exponential function is well known for modeling many phenomena. I have to think that its inverse, the natural logarithm should model some things we see as well.

***

Here is a blog link to a guy writing on kind-of similar pieces as the above. It is worth your while to take a look:

https://pearlsforswine.wordpress.com/

Saturday, June 16, 2012

Review of Barron's -- Dated 18 June

Ah, the tranquility of a weekend without Italian class… It allows me more time to write for my blog. Time I really need this weekend, Barron’s is excellent, and this Review will be LONG!

The Cover Story “Here Comes Trouble!” is about the looming disasters of Social Security, Medicare, Medicaid and the new Obamacare. Author Gene Epstein chronicles something almost all of you dear readers already know: that there are HUGE holes in financing these entitlements, and that it will be VERY HARD for Washington to resolve these problems. There is a nice graph which shows how these programs will eat up over 25% of GDP by 2087, when the last of the Baby Boomers reaches 110 years of age…

There is no money to fund all of this. Not even Treasury bonds. Just some IOUs… The first of America’s 78 million baby boomers turns 66 this year, and so are now eligible for full Social Security benefits. Epstein writes:

“In short, the future has arrived, and it doesn’t look pretty.”

Indeed, it is a very good article. Sobering… I am 56 and not eligible for Social Security. Medicare may come in handy though, if it is still there when I need it…

***

Alan Abelson (“Rumors to the Rescue”) reminds us that the G-20 guys are all getting together for tacos and margaritas down in Mexico, and maybe talk about the world economy. “Lady Rumor”, he writes, passes word around that the Fed’s Open Market Committee may just do a little easing, and that pushed stocks up. He then goes on to mention Jamie Dimon (CEO of JP Morgan) easily batting away questions from Congressmen. He says the coming week will likely be exciting…

He then goes on to write that the banks still have a lot of housing REO (that own via foreclosure). Things look, still, pretty bad for banks and homebuilders.

Abelson then finishes with comments on other economic indicators that are, well, rather bleak. Manufacturing is down. Business conditions are down in another survey. The Chicago PMI down from last month. No “Green Shoots” from Alan Abelson this weekend!

***

Michael Santoli (“Streetwise”) sees continued value in global companies with good positions and strong financials, companies like Abbott Labs. (ABT), Pepsico (PEP), Clorox (CLX), MasterCard (MA), Brown-Forman (BF/B) and McGraw-Hill (MHP).

***

The “Review & Preview” double page has some nice little gems. There is a short piece on how the railroads will get a lot of business when the economy eventually comes back (as truckers have cut their fleets and they themselves are customers of the railroads for long distance intermodal transport).

Nizar Manek writes that “Italy is moving into the cross-hairs.” “Italy is too big to save save, says [Ed] Altman…”

[Ed. comment: if Italy goes, then France goes, then Germany goes…]

“Review & Preview is also where “He said:” is. Here is this weekend’s He said:”

“There are serious downside risks here. The ECB…will continue to supply liquidity to solvent banks where needed.”

ECB President Mario Draghi

Feel better? Oh, and by the way, Barron’s has LOTS more to say, negative, about Europe this weekend. Read on…

***

Andrew Bary interviews Thomas Russo of Gardner, Russo and Gardner. Russo manages about $5 billion of assets. He is a big fan of companies with big global brands (Santoli (above) has written thoughts like this in the past two issues of Barron’s), some of these companies he has been holding for over 20 years.

He even likes these kinds of companies even where the founding families retain control. In these cases, the families are thinking longer term, not about short –term profits, but building wealth over time. Family controlled companies he likes:

Berkshire Hathaway (BRK/A, BRK/B)

Brown-Forman (BF/B) ß mentioned twice, they own Jack Daniel’s

Pernod Ricard (RI.France) ßthey make a very good absinthe!

He also likes:

Nestle (NSRGY)

Richemont (CFR.Switzerland) ß luxury brands like Cartier and Montblanc

Heineken Holding (HEIO.Netherlands)

Unilever (UN) ß which he likes more than PG

Russo also offered up an interesting comment about HIMSELF and investing. He chooses companies involved in making what he likes, and what he will stay close to. He does not care about semiconductors, because he feels that he would be a poor investor in that industry. That is a take that you rarely hear from professional money managers, bravo Thomas Russo!

***

Sandra Ward contributes a bullish piece: “Nabors: Ready for Pay Dirt”. NBR is the world’s largest onshore oil & gas drilling company. The stock lost over 50% of its value, partly because of upper management abuses (wildly over paid). She writes that NBR seems undervalued almost any way you look at it, and that if oil drilling picks up, this could be a big winner. I’ll go along with that, we will see.

***

Neil Martin writes a piece where he discusses Japan with Ed Merner, who has been in Japan since 1961. Merner believes much of Japan is undervalued, and that many investment companies closed shop after Fukushima. Merner notes that about 70% of companies on the Topix (an index, like our S&P 500) trade below book value (vs. 20% on the S&P 500 or 30% on London’s FTSE).

***

Jim McTague (“D. C. Current”) writes that Obama has changed his tune on oil drilling. Obama is now claiming credit increased US oil and gas production! Even though most oil and gas is produced on private land… McTague:

“…, Obama feels he must lip-sync a version of “drill, baby, drill””.

The president’s pollsters must have found that the public largely FAVORS more drilling.

McTague goes on to write that the voters are increasingly viewing Obama’s policies as flops. The president promised a healthy economy by now (some 3 and ½ years since taking the helm), and Obamacare is unpopular. The oil industry views Obama as job killer… They would be happy to see him lose.

***

Andrew Bary writes a bullish piece Scotts Miracle-Gro (SMG). The stock took a recent hit on a pair of bad results and projections.

Ah, no thanks.

***

Bob O’Brien writes a bullish piece on Lamar, the nation’s third largest billboard company.

Ah, no thanks. Three bullish pieces so far…

***

Shirley A. Lazo writes that some tech companies are finally strting to pay decent dividends. AAPL, IBM, Intel (INTC) and MSFT are paying dividends now. HP has been paying dividends since 1965.

Google (GOOG) and eBay (EBAY) are not expected to pay dividends anytime soon however.

***

Tiernan Ray (“Technology Week”) tells us that at long last that Dell (DELL) will pay dividends as well.

He also writes of the general paranoia (“Only the paranoid survive.” Andy Grove) among the tech companies. Most tech companies view their industry as zero sum game, and that each may have to eat up others or get eaten in turn. He provides a list of companies that failed or got eaten up:

Eastman Kodak

Digital Equipment

Wang Labs

National Cash Register

Silicon Graphics

Sun Microsystems

Amdahl

He finishes by writing about struggling Nokia, it will have to take another 1 billion euro charge…

***

Mark Veverka (“Plugged In”) gives us a sneak peak from Apple. Even though Apple did not show off an Apple TV nor a new iPhone, the company DID release a barrage of new technology to keep them ahead of Google, Microsoft and H-P. It looks like they are going to team up (at least to some degree) with Facebook (FB) to allow, iPhones (etc.) to share photos (etc.). They working with TomTom to get their own mapping technology, and Apple has said that they would eventually like an iPhone in every CAR, which course would not be good for GPS maker Garmin (GRMN). Apple’s new iPhone OS 6 will likely work out very well for them.

***

Mike Hogan (“The Electronic Investor” caught my eye when he described in detail a company offering information on ALL 40,000 publicly traded companies in the world! Each night CapitalCube runs an automated valuation analysis on each of these companies, focusing in fundamentals, not technical analysis. The service is FREE now, for about a month, then it will cost $79 / month (more for premium services).

I went and tried it out: capitalcube.com. I entered NSK, Ltd., Japan’s big bearing company (very little information is available about NSK here in the USA, it does not trade as an ADR). Out came metrics and ratings.

You should take a look, especially if you invest overseas.

***

“ETF Focus” has written before about new and complex ETFs hitting the market now. Author Brendan Conway writes of new ETFs attempting to track purchases and sales of stocks bought by Hedge Funds.

Ah, no thanks.

***

Lawrence C. Strauss writes this weekend’s “CEO Spotlight”, an article I have grown to enjoy when Barron’s publishes it (looks about every two weeks).

George Barrett is the CEO of Cardinal Health (CAH), they are a close second in size to drug distributor McKesson (MCK). Cardinal distributes generic drugs (as well as other medical products) to independent pharmacies and may other types of medical customers. Companies like Cardinal are one of the few in health care that work to LOWER health care costs.

Barrett is 57 and appears to have done a nice job running Cardinal. He graduated with a BA in History and Music. Right out of school, he played folk-music at night, before landing a job in the medical industry. He found working in the corporate world fulfilling. George Barrett is proof that Music majors and History majors can make it out there in the corporate world.

***

A couple of times I have tried to pass along the essence of CARTOONS that I see in Barron’s. Many of the cartoons are extremely good!

P. C. Vey draws two guys sitting at the bar with drinks. One is a doctor, in uniform. The doctor turns to the other man (his patient) and asks “If not now, when do you want to talk about these test results?”

I started reading the Editorial by Thomas Donlan about computerizing the campus, an idea that MIT offered up a couple of years or so ago where you could take real classes via the internet. When he then went on to write that the government should get involved, I then asked myself, “What, is Thomas Donlan running off the reservation again (acting out of character by favoring more government)…”? I took another look, this week’s Editorial is NOT by Thomas Donlan but by someone else: Steve Klinsky. LOL! |;.!

***

In the Market Week Section Vito Racanelli and Jacqueline Doherty jointly write "The Trader" which reviews the equity market of the past week. FINALLY we are seeing Europe discussed (disgust?), and we also see a theme mentioned TWICE above in this weekend's issue: STRONG that don't need to borrow from banks, companies like Johson & Johnson (JNJ), IBM, Texas Instruments (TXN) and SAP (SAP).

They do not like truck and engine maker Navistar (NAV) as the company has not been able to get its new diesel engine up to new EPA cleanliness standards...

"European Trader" columnist Jonathan Buck has lately been keeping a good eye the perils there in Europe. He writes that even though things are very bad in Greece (big French retailer Carrefour just pulled out of Greece), that main act is really going to be Spain. I agree. ALL of Europe's sovereign debt went south last week (that is, investors demanded higher yields) even on German debt. Egan-Jones (finally I read about them somewhere else other than Zero Hedge) rates Spain as junk. The cowardly other ratings agencies have not. Yet.

Randall W. Forsyth ("Current Yield") writes that the central banks are just buying time... Well, yes. Treasuries are at their lowest ever, as Europeans and others flock to the safe haven (not so safe?) of Traesuries. He points out the Germans cannot, as in are not able to, keep covering the bad debts of the likes of Spain.

They do not like truck and engine maker Navistar (NAV) as the company has not been able to get its new diesel engine up to new EPA cleanliness standards...

"European Trader" columnist Jonathan Buck has lately been keeping a good eye the perils there in Europe. He writes that even though things are very bad in Greece (big French retailer Carrefour just pulled out of Greece), that main act is really going to be Spain. I agree. ALL of Europe's sovereign debt went south last week (that is, investors demanded higher yields) even on German debt. Egan-Jones (finally I read about them somewhere else other than Zero Hedge) rates Spain as junk. The cowardly other ratings agencies have not. Yet.

Randall W. Forsyth ("Current Yield") writes that the central banks are just buying time... Well, yes. Treasuries are at their lowest ever, as Europeans and others flock to the safe haven (not so safe?) of Traesuries. He points out the Germans cannot, as in are not able to, keep covering the bad debts of the likes of Spain.

"Commodities Corner" today was about cotton. Cotton prices are low, so China took the opportunity to buy a whole lot from the US. Cotton prices may go up, writes author Leslie Josephs, but much.

Another cartoon, this one by Danny Shanahan. The bum on the corner says to the man giving him a donation: "Everything goes straight back into the business." I am telling you, the CARTOONS in Barron's are often very good!